PAM PRIOR

BESTSELLING AUTHOR

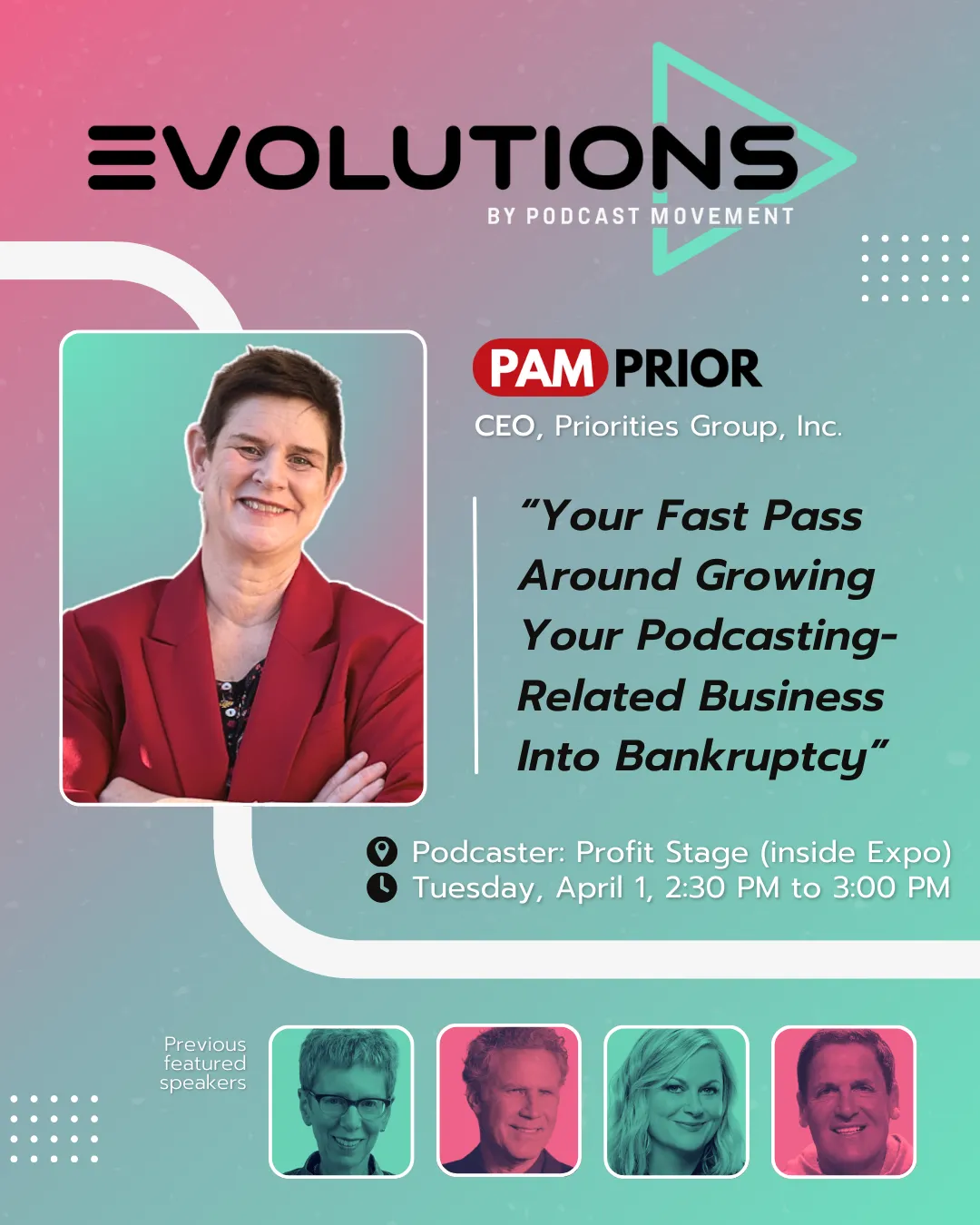

FEATURED SPEAKER

CFO FOR 20 YEARS

OUR CORE VALUES

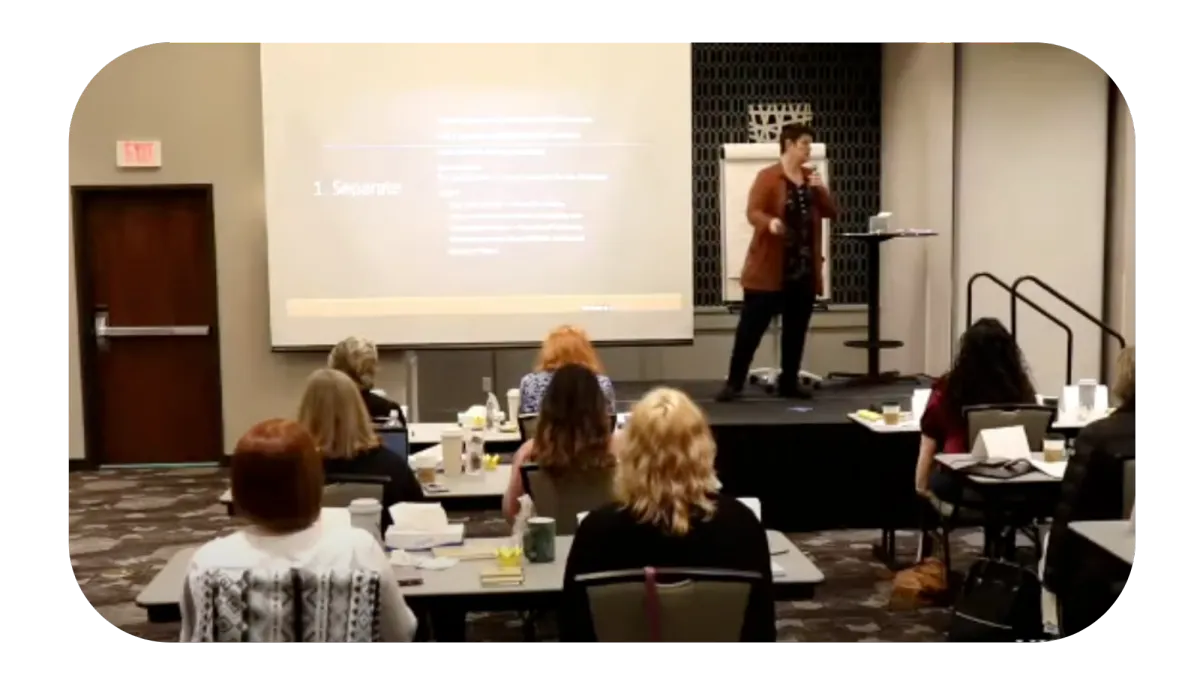

SPEAKER

PAM PRIOR MAKES

FINANCE FUN.

Pam’s Entrepreneur Friendly Profit Concierge® Blueprint has provided hundreds of business owners the full set of tools and knowledge they needed to rule their business finances like the CEO Rockstars that they are. As a speaker, she connects engagingly with audience members, showing them, with humor and compassion, how they, too, can turn their overwhelming finance challenges into their best friend.

Schedule Your FREE Financial Blueprint Call with Pam!

What You’ll Walk Away With

This isn’t a webinar or a course—this is your 1:1 Blueprint.

By the end of this session, you will have:

Two to three high-impact moves to clean up your financial chaos

A simple roadmap to get your business finances working for you

Strategic advice from Pam Prior—CFO to 6, 7, and 8-figure CEOs

BOOKS

YOUR FIRST CFO

The Accounting Cure for

Small Business Owners

Published by: Morgan James Publishing, 2018

FOUNDER TO EXIT

A CFO's Blueprint for

Small Business Owners

Published by: Difference Press, 2024

PODCAST HOST

Cash Flow with Pam Prior is the podcast that takes the mystery out of business money. Bestselling author and CFO Pam Prior answers the real questions entrepreneurs are asking—like how to pay yourself, why cash flow always feels tight, and what numbers actually matter. Every episode delivers simple, practical answers in plain English, so you can finally feel confident about your finances and focus on growing your business.

S6:E10

You’re Not Broke, You Just Hate Math: Making Cash Flow Manageable

S6:E5

Tax Time: Unlocking Deductions for Business Owners

ABOUT PAM

AN EXPERIENCED PARTNER

FOR YOUR BUSINESS

Pam Prior is a Best Selling Author, Radio Show Host, Financial Executive, CPA, Speaker, Teacher and “Cash Flow Quarterback.” An experienced CFO, she assesses businesses quickly and thoroughly – defining a clear-cut roadmap for putting your financials to work for you, fully aligned with your strategies. Although her methodology is time-tested and replicable, specific solutions are tailored directly to her clients and represent how they think about their businesses.

WHO

I AM

THEY LOVE ME!

KATE LABROSSE

"IF YOU'RE A BUSINESS OWNER AND YOU DON'T HAVE A CFO OR FINANCIAL TEAM YET THEN DO YOURSELF A FAVOR AND HIRE PAM ASAP...PAM LEADS WITH HER HEART. SHE TAKES THE INTIMIDATION OUT OF FINANCES, HOLDS YOUR HAND, CHEERS YOU ON, AND HOLDS SPACE FOR YOU AS YOU EXPERIENCE THE HIGHS AND LOWS OF ENTREPRENEURSHIP."

DR. ANGELA LAURIA

"MY BUSINESS IS GROWING EXPONENTIALLY, AND I NEED A CFO TO HELP SET US UP FOR A CLEAR, CRISP, FLEXIBLE, AND RELIABLE FINANCIAL (CASH) FORECAST,WITHOUT SLOWING US DOWN. PAM IMMEDIATELY EARNED MY TRUST, AND JUST AS IMPORTANTLY, THE TRUST OF MY TEAM. HER CONFIDENCE, EXPERIENCE, AND CARING ARE EVIDENT AT THE VERY FIRST MEETING."

DR. SHAUNA MENARD

"I AM SO GRATEFUL FOR PAM PRIOR! SHE TAKES THE INTIMIDATION OUF OF FINANCE. I AM NEVER MADE TO FEEL "STUPID" OR "A LOST CAUSE". I LOVE HAVING MY FINANCES ORGANIZED...PAM GOES ABOVE AND BEYOND IN HER SERVICE.

THANK YOU PAM PRIOR AND THE WORK YOU DO! YOU MAY HAVE ALSO SAVED A MARRIAGE. "

RECEIVE INFORMATIVE INSIGHT AND DIRECTION

FOR YOUR BUSINESS GOALS!

CONTACT

CONNECT WITH PAM

If you have any questions or professional inquiries please shoot her an email through this form. She would like to hear from you, depending on your inquiry of course.