The CFO Advantage: Conquering Financial Complexities for Small Business Owners

As a small business owner, you know that managing your company’s finances is crucial for success (and if you don’t, you haven’t been paying attention to these blogs!).

But what if I told you that hiring a Chief Financial Officer (CFO) can be the key to unlocking your business’s full potential?

Because a CFO is not just for crunching numbers; they are a strategic partner who can navigate the complexities of your business and steer you toward sustainable growth.

Let me share my experience early in my career with a skilled CFO named Sarah (name changed for privacy).

When we first brought her on board, I wasn’t sure how much impact she could really have. As a budding financial professional myself, our problems seemed like they would take an entire village to solve.

But I was (happily) proven to be so, so wrong.

Sarah’s insights and strategic foresight were absolutely invaluable in identifying opportunities we never knew existed and mitigating risks that could have held us back.

For example, she helped us:

- Identify cost-saving measures that reduced our expenses by 15%

- Develop a pricing strategy that increased our profit margins by 10%

- Secure funding for a new product line that generated $500,000 in revenue

A skilled CFO like Sarah brings more than just financial expertise to the table; they offer strategic leadership that drives growth and sustainability.

And Sarah’s ability to analyze market trends, forecast economic conditions, and evaluate investment opportunities was crucial in shaping the company’s direction.

Now, I realize that for anyone new to the concept, forecasting the future may sound a little “woo-woo” or like something out of a crystal ball, but with the right CFO, it’s a strategic tool that can open your eyes to your business’s growth potential.

Unlocking Growth Potential

The right CFO isn’t just going to say, “Oh, I’ll just give you the reports every month.”

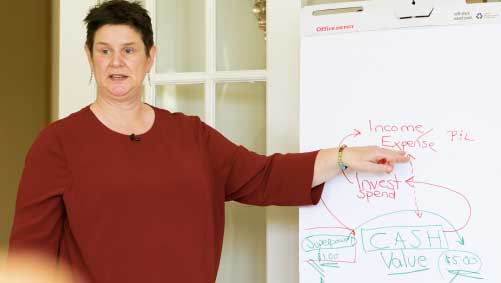

The right CFO will evaluate everything related to your financial situation, take ownership of it, and set you up with an information flow that aligns with the vision you have of your business.

The right CFO’s expertise in forecasting techniques (see part 1, part 2, part 3, and part 4 of why forecasting is crucial) allows you to allocate resources effectively to support your growth initiatives.

And whether it’s predicting cash flow needs, adjusting pricing strategies, or exploring new markets, the right CFO empowers you to navigate finances with calmness, clarity, and confidence.

Because in today’s ever-changing economic landscape, having a skilled CFO like Sarah is more important than ever.

With Sarah by our side, we were able to adapt and innovate proactively. We developed a 3-year strategic plan that included:

- Expanding into two new markets

- Launching three new product lines

- Increasing our workforce by 25%

By ensuring that our strategic planning aligns with our current objectives and prepares us for whatever the future may hold, our incredible CFO Sarah positioned us for continued success.

“But Aren’t CFOs Notoriously Hard to Reach?”

A good CFO? No, they absolutely should not be impossible to contact.

Because in today’s world, we operate completely differently than we did even five years ago.

Everything — in business and in life — happens at light speed.

And as a business owner, there are business decisions you need to make, day in and day out — you need to make them quickly, and they need to be informed.

So you should demand responsiveness of a CFO that supports that speed.

Because guess what? It’s not about just hiring ~ANY~ CFO.

You want to understand their tools for accessibility (or capacity to migrate to your own communications tools); and then set the right expectations up front.

(Fun fact: Something the more futuristic CFOs do is set up communication forums for clients to send in their general questions — obviously not including confidential numbers and situations — and sometimes they may even host “office hours” online.)

But overall, it’s not about how much they’re there; it’s about how they show up when they’re there, as well as their trustworthiness (in YOUR eyes) when they aren’t.

You need someone who has the capacity to fully integrate financial advice smoothly into the context of your operation strategy.

Someone who gets what you are going through, understands your vision, and has your back.

Someone who you can call and talk through business issues with, no matter how confidential, confusing, embarrassing, or potentially alarming.

And that, my friends, is exactly what a skilled CFO can be in your business: a solid partner who can be your go-to for all things financial, whenever you need it.

Ready to Navigate Your Financial Future?

If you’re a small business owner, CEO, or entrepreneur looking to take your company to the next level, consider hiring a skilled CFO. They can help you:

- Identify cost-saving opportunities and increase profitability

- Develop effective pricing strategies and revenue generation plans

- Secure funding for growth initiatives and expansion plans

- Craft long-term strategic plans that align with your business objectives

Don’t let financial challenges hold you back from achieving your business goals.

With the right CFO by your side, you can tackle any financial hardship with confidence and clarity.

Looking for an expert CFO to diagnose your biggest financial headache?

Give us a call today and let’s chat.

Author, Virtual CFO, and Finance Coach

“Your First CFO: The Accounting Cure for Small Business Owners” on AMAZON

“Founder to Exit: A CFO’s Blueprint for Small Business Owners” on AMAZON