Hey there, it’s Pam Prior, your cash-finding guru for entrepreneurs on the path to six-, seven-, and eight-figure glory! Today, I’ve got a cool story to share, courtesy of a fantastic little toy that just landed in my mailbox. Brace yourself for some serious business wisdom hidden within this tiny contraption.

The Marvel of the Reusable Straw

Picture this: I received a package, and when I opened it, bam! It was spring-loaded and it transformed into a reusable straw when I pulled it out of its container. Mind-blown, right? Now, I know what you’re thinking—what does a funky straw have to do with bookkeepers and accountants? It’s all about finding the answers you need, so stick with me.

Simplicity Rocks: Less Engineering, More Results

When I look at this cool toy, I’m not concerned about its intricate engineering or the scientific jargon behind it. All I care about is that it’s a super handy straw I can whip out at a restaurant and even clean with the included squeegee. It’s all about simplicity.

Similarly, entrepreneurs don’t need to get tangled up in the technical mumbo-jumbo of your number-crunching accounting and bookkeeping sidekicks. Just tell them what you want, and they’ll deliver the goods.

But – here’s the real question: What do you want?

As it turns out – I didn’t need a reusable straw, but I got one in the mail, so I used it, even though it didn’t suit my needs.

How many entrepreneurs are stuck with bookkeepers who really don’t suit their needs? Accountants who give us reports that make no sense to us?

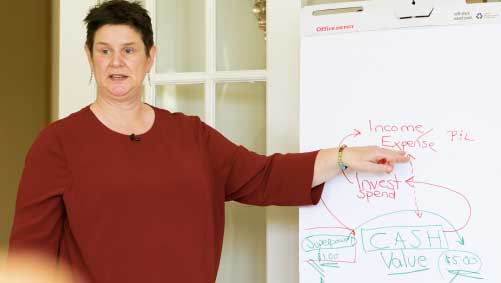

Now, let’s dive into the secret sauce that’ll revolutionize your definition of what you need: CONTEXT. And, specifically, two contexts—time and expectations. These two bad boys will set you on a path to enlightenment and help you make those moolah-chasing decisions like a pro.

The Context of Time: From Monthly Snooze to Progress Party

No more snoozefest with isolated monthly financial statements. If you are getting a sheet of paper with just one column of numbers on it each month, it’s time to let your bookkeeper know that you demand to see that chronological rollercoaster ride of your numbers. You want those financial statements to show the month-to-month story of your business, from January to February, March to April, and beyond.

The context of time: It’s like a blockbuster movie, but with your business as the star!

So how do you go about getting reports like this? Just tell your bookkeeper to: “Run me a 12-month rolling set of financial statements: Balance Sheet, Income Statement, and Cashflow.” (You can even read it right off of this blog or copy and paste it into an email to them.)

Once you get those reports back, you’ll finally be able to see trends, peaks, valleys, and effects of your business decisions.

The Context of Outcomes vs. Expectations: Reality Check

Time to unleash your business psychic skills. You’ve got a pretty good gut feel of what your monthly numbers should look like—those projected sales and other mystical metrics dancing in your head. So, here’s the deal: tell your bookkeeper what those expectations are. And then have them whip out their detective cape and compare the actual results with your predictions. This comparison will reveal hidden truths about what’s actually happening in your business. It will confirm or reject the assumptions you are making about those decisions you make day in and day out. You’ll see when things work the way you planned for them to, and you’ll see when your strategy needs tweaks. Most importantly you’ll be armed with the power to make calculated moves to ascend cash flow mountain.

It’s Showtime, Baby!

With these simple steps, you’ll unlock financial insights that would make even the savviest of business gurus swoon. No more imposter syndrome or fear of the unknown. No more putting those reports in a drawer swearing to look at them next month, or next quarter, or next year.

You deserve a financial package that’s a beautifully bound book spilling out all the golden nuggets about your cash flow and profitability.

It’s time to take the stage, my friend, and own your financial freedom!

If these tips resonate with you, show some love and leave a comment. Your feedback is my fuel, and I’m here to serve YOU. Oh, and let’s not forget about your fellow entrepreneurs struggling with bookkeeping blues—share this post with them, so they can escape the drudgery of meaningless financial reporting.

We’re on a wild entrepreneurial ride together, my friend, and my role is to introduce you to the awesome relationship you can have with your numbers as you turn them into one of the best tools you have to assist in achieving your dreams.