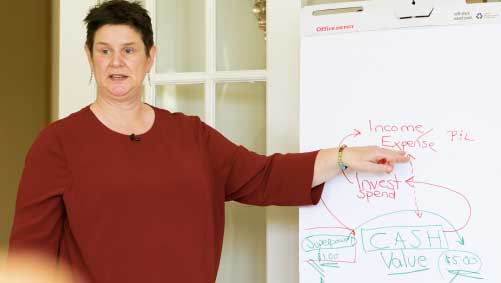

Let’s talk about two things that can give you the upper hand when it comes to the cash flow of your business. We’re talking about collecting money quickly and spending it slowly. Sounds simple, right? Well, I’ve picked up a few tips and tricks along the way that can help you master this art without upsetting your customers or scaring your vendors. So, let’s dive in and discover how to forecast your cash flow in a way that keeps you out of potential future troubles. And guess what? Putting it all on paper won’t make the problem worse, I promise!

Forecasting for Growth and Confidence

One of the cool things about understanding forecasting is that it allows you to pursue growth confidently. You can use your forecast to make sure you’re on track with your brilliant ideas without falling into a never-ending pit of debt. It’s all about knowing if you’re hitting your goals, and if not, being able to course correct or pivot along the way.

Embracing Failure and Learning

Now, let’s be real here. We all know that failure is a part of the game. In fact, I embrace it wholeheartedly. If you’re not making mistakes, then you’re probably not pushing yourself hard enough. Taking risks and challenging the status quo means you’ll stumble, miscalculate numbers, or even launch a product that falls flat on its face. And that’s okay! Especially when you have the right financial tools in place to adjust, learn from it, or gracefully move on.

And here’s where the magic of cash flow forecasting comes in. It’s not just wishful thinking or hoping your way out of a problem. No, no! With a solid forecast, you have real data and numbers (which, by the way, aren’t even hard to put together) backing you up.

The Trick: Incentivizing Early Payments

Now, let’s talk about payment plans. Many of us offer flexible payment options to our customers. You know, things like “Pay $2,000 now and $1,000 per month for the next six months” or “Get my awesome product for $200 today or $100 per month for three months.” And hey, for larger customers, we might even go with longer terms like 30, 60, or even 90 days. But what if you spot a cash flow issue in your forecast? Don’t worry, I’ve got a trick up my sleeve for you. It’s all about accelerating those payments.

Picture this: You approach your existing clients with an irresistible offer. You say, “Hey, I’ve got this super exciting enhancement for our program, but it’s only available to a select group of customers. Here’s the deal: If you write me a check for $350 or $400 today, we’ll call it even, and you won’t have to worry about those remaining six months of $100 payments.” See? Creative, non-threatening, and it gives your customers a financial benefit for paying you early.

Win-Win Cash Flow Strategies

So there you have it, my tip of the day: find a way to give your customers the incentive to pay you early without sending them into a frenzy. It’s all about being resourceful and making it a win-win for everyone involved.

I hope you found these insights helpful! If you did, show some love by leaving a comment or sharing it with fellow entrepreneurs who could use a cash flow boost. Your feedback is invaluable to me, and I’m here to provide information that serves you best.

Keep rocking those cash flow strategies, and remember, you’ve got this!