Hello again and welcome back to forecasting month!

We’re covering the why and the how of forecasting to predict and hopefully minimize any nasty tax impact next year. Whether you are just starting out or you’re a $10 million dollar business, this is an exercise that you want to be able to do.

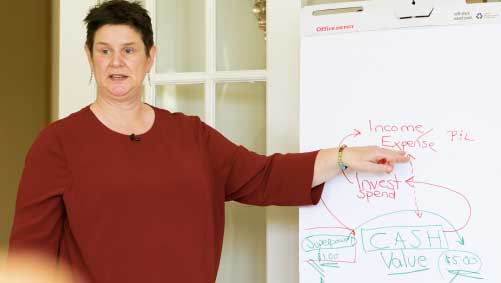

So let’s just recap really quickly what we’ve talked about this week so far.

The Why and How of Forecasting

First of all, a good reason to do a forecast for your business is to try and prepare for and minimize the impact of taxes for this year. The second piece we’ve covered is the how. And when we talked about revenue, I sent you home with an exercise to add up your revenue collected from customers in the first nine months; and we also covered that doing so can get complicated.

So here’s where you as an entrepreneur take 15 minutes and think logically about your business. As you’re evaluating this, what you’re really trying to discover is how much cash you are gonna collect from your customers in the next three months.

Consider these factors as you think about doing your forecast that might shift things around:

- Are there going to be significant changes in my business over the holidays?

- Do my customers have any reason to increase or decrease their buying from me during the holidays?

- Am I going to be taking time off?

Number One: Changes in the Business

Think about any potential changes in your business over the holidays and how that may impact your revenue.

Number Two: Customer Increase/Decrease

Consider if there are any upcoming circumstances that affect your customers’ likelihood of buying from you during the holidays.

Does your customer base buy more of your stuff during the holidays? Or do they take that time off? This can either increase or decrease your October, November, and December revenue from what you were making before.

Now, if you’re a recurring revenue type business, you may not have as much of an issue. But if you’re getting paid by the hour and don’t have a membership type fee, or if you’re not gonna be signing on new members, this will definitely affect your business.

Number Three: Personal Time Off

Taking time off can definitely affect your forecast. Let’s just assume that you plan to take off two weeks in November and two weeks in December for the holidays. If your average is 10,000 a month, decrease that forecast a little bit to 10,000 in October and 5,000 each in November and December.

Then when you add it all, your total comes out to $110,000: 90,000 so far plus 10,000 in October and 5,000 each in November, December.

See what I’m saying here?

This is merely an exercise to determine if there’s anything about your business that’s gonna change because of you and your time.

Every single client of mine is doing this to verify the work that their bookkeepers, accountants, and sometimes even I am doing for them.

And every single entrepreneur, no matter how big you are, can do it as well. The value will show up.

Next time I’ll talk about a couple more little quirks that can help drive your decision process around this.

And trust me – you don’t wanna miss out on the next one, folks.