Financial KPIs Every Small Business Should Monitor

In the world of small business, financial health is paramount, and Key Performance Indicators (KPIs) are the vital signs you need to monitor to ensure that health.

Understanding and tracking the right financial KPIs gives a clear picture of your company’s performance, and it provides the insight needed to make informed decisions to drive growth and profitability.

So, here’s a quick summary I whipped up of the essential financial KPIs every small business should keep an eye on:

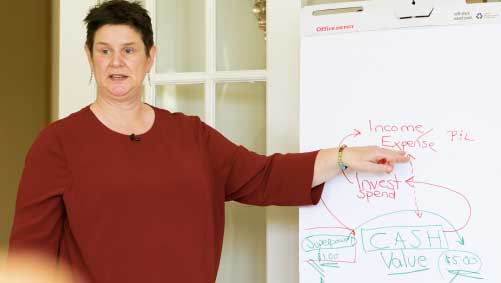

1. Cash Flow

If you know me, you know that I’m serious about managing cash flow – it’s my thing.

Because cash flow is the lifeblood of any small business.

Simply put, it measures the net amount of cash and cash equivalents moving into and out of a business.

Monitoring your cash flow helps ensure you have enough cash to cover your expenses and indicates the overall financial health of your business.

Plus, positive cash flow indicates that a company’s liquid assets are increasing, allowing it to settle debts, reinvest in its business, return money to shareholders, pay expenses, and provide a buffer against future financial challenges…which you’ll be thankful for later.

- How to Calculate: Cash Flow = Cash Received – Cash Spent

- Why It Matters: Understanding cash flow is crucial for managing day-to-day operations, planning for future growth, and ensuring you can meet your financial obligations.

- How to Improve: (In short) optimize billing processes, manage inventory efficiently, and control expenses.

2. Profit Margins

Profit margin, both gross and net, provides insight into your business’s profitability after accounting for costs and expenses.

Gross Profit Margin: Reveals the percentage of revenue that exceeds the cost of goods sold (COGS), essentially showing how efficiently a company is producing or sourcing its products.

Net Profit Margin: Shows the percentage of revenue left after all expenses have been deducted from sales. This comprehensive measure reflects the overall profitability of a company, incorporating all aspects of business operations.

- How to Calculate:

- Gross Profit Margin = (Revenue – COGS) / Revenue

- Net Profit Margin = Net Profit / Revenue

- Why It Matters: Profit margins help you understand the effectiveness of your pricing strategy, cost control, and overall financial health. They are critical indicators of the company’s overall profitability!

- How to Improve: Improve gross profit margin by increasing prices, reducing direct costs, or optimizing production processes. Improving net profit margin often requires a multi-faceted approach, including revenue growth strategies, cost reductions, and operational efficiencies.

3. Accounts Receivable Turnover

This KPI of Accounts Receivable Turnover measures how quickly a business collects outstanding debts from customers, indicating the efficiency of the company’s credit policies and how well it manages its receivables.

The faster a company can collect, the better its cash flow!

- How to Calculate: Accounts Receivable Turnover = Net Credit Sales / Average Accounts Receivable

- Why It Matters: High turnover indicates efficient collection processes, while low turnover might suggest issues with credit policies or customer payment behaviors.

- How to Improve: Tightening credit terms, offering early payment discounts, and enhancing collection efforts.

4. Inventory Turnover

Inventory turnover shows how quickly your business sells and replaces inventory within a given period.

High turnover can indicate strong sales or ineffective buying, while low turnover can signify weak sales or excess inventory.

- How to Calculate: Inventory Turnover = Cost of Goods Sold / Average Inventory

- Why It Matters: Understanding this metric helps manage stock levels, reduce holding costs, and optimize inventory purchasing decisions.

- How to Improve: Better demand forecasting, efficient inventory management practices, and strategies to clear out old or slow-moving stock.

5. Current Ratio

The KPI of current ratio is a liquidity ratio that measures a company’s ability to pay off its short-term liabilities with its short-term assets. A ratio under 1 can indicate liquidity problems, while a very high ratio may suggest an excess of assets being underutilized.

- How to Calculate: Current Ratio = Current Assets / Current Liabilities

- Why It Matters: This ratio indicates the financial health of your business and its ability to meet short-term obligations.

- How to Improve: To improve this ratio, companies can manage their current assets more effectively or restructure short-term liabilities.

6. Debt-to-Equity Ratio

This ratio compares a company’s total liabilities to its shareholder equity, providing insight into the company’s financial leverage. A balanced ratio suggests a healthy mix of debt and equity financing.

- How to Calculate: Debt-to-Equity Ratio = Total Liabilities / Shareholders’ Equity

- Why It Matters: It helps assess the risk level of your business and its reliance on debt financing.

- How to Improve: Paying down debt, increasing equity through retained earnings or issuing new shares, or a combination of both.

7. Return on Investment (ROI)

ROI measures the profitability of an investment relative to its cost, crucial for evaluating the efficiency of different investments.

- How to Calculate: ROI = (Net Profit / Cost of Investment) x 100

- Why It Matters: It helps small business owners assess the effectiveness of their investment strategies and make informed decisions.

- How to Improve: Increasing the returns of investments, reducing costs, or reallocating resources to higher-yielding opportunities.

In essence, effectively tracking these financial KPIs is fundamental for small business owners aiming to navigate their venture’s financial health and strategic growth.

Each of these KPIs provide crucial insights, enabling business owners to make well-informed decisions that foster stability and growth.

By regularly monitoring these indicators (key word: REGULARLY), you can identify strengths to build upon, pinpoint areas needing improvement, and adjust strategies to better align with your business objectives.

Ultimately, your commitment to understanding AND acting on these financial metrics can be a significant determinant in your business’s long-term success and resilience in the competitive market landscape.

Author, Virtual CFO, and Finance Coach

“Your First CFO: The Accounting Cure for Small Business Owners” on AMAZON