The cash cycle is the heartbeat of your business’s financial health.

It’s a fundamental concept in business finance, but its intricacies can often feel daunting.

Today, we’re simplifying and demystifying the complexities of the cash cycle to equip you with the knowledge needed to navigate your financial journey with confidence.

Read on as we break down the cash cycle into bite-sized, easy-to-digest pieces.

Demystifying the Journey: From Purchase to Profit

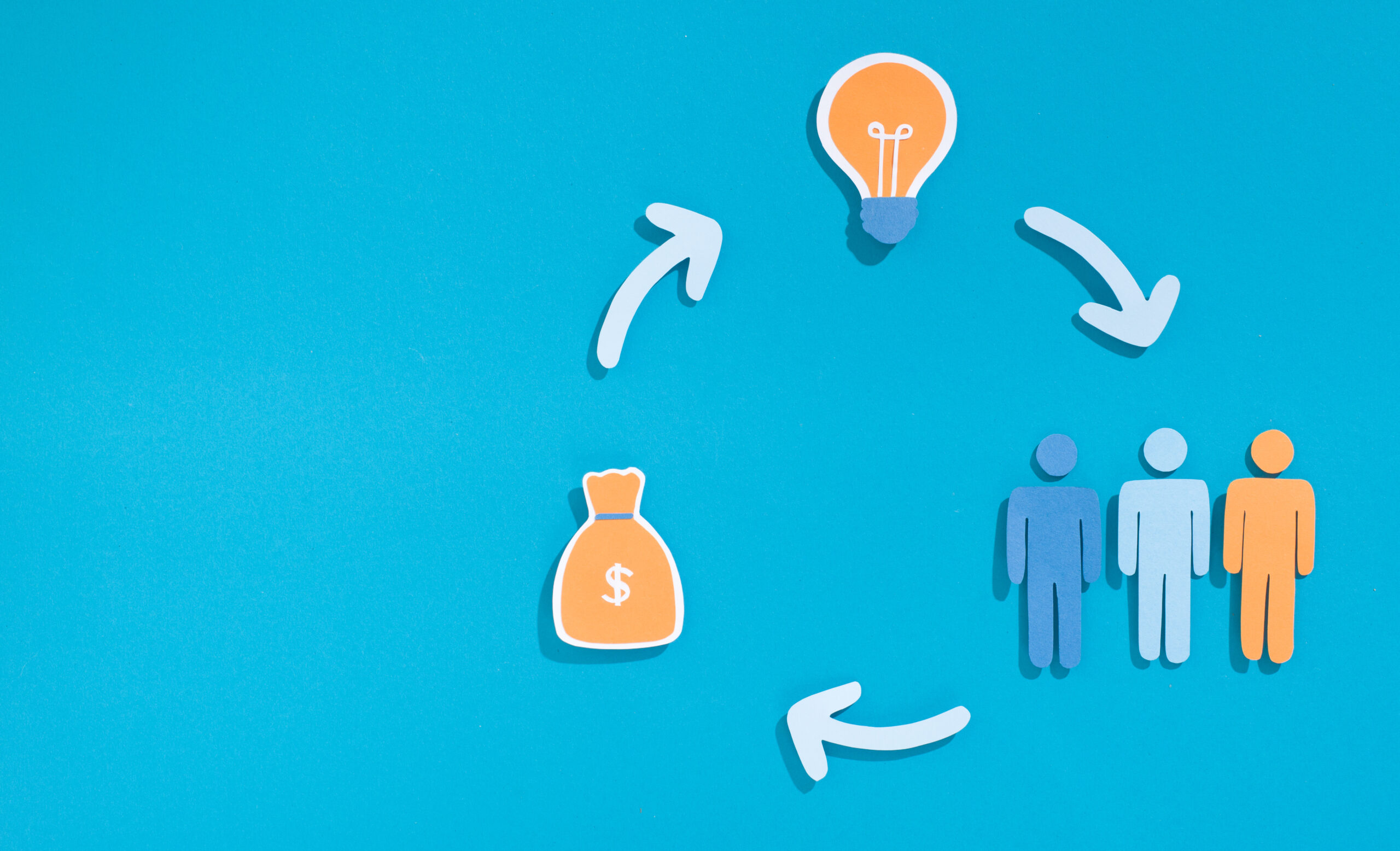

Your money goes on a wild journey the moment it leaves your business account…

…from splurging on inventory or services, to selling your stellar products, to finally watching those sales morph back into sweet, sweet cash in your account…

And this rollercoaster ride?

That’s your cash cycle, friend – and it’s the backbone of your business.

Ditching the fancy finance lingo for a minute, let’s break it down to the absolute basics:

Step one: You toss cash into resources or inventory, be it raw materials or marketing.

Step two: Your offerings hit the market.

Step three: Sales return to your bank account.

And so the cycle begins again.

With each transaction, revenue flows back into your bank account, fueling the cycle anew.

Your hard work and dedication translate into tangible financial returns.

And that’s it!

That’s the cash cycle in a nutshell.

Not so scary, right?

Key Components Every Entrepreneur Should Ace

While mastering the cash cycle is non-negotiable, it doesn’t have to be rocket science.

Let’s break it down further:

- Inventory Management: Manage overstocking to keep funds flowing freely

- Accounts Receivable: Speedy payments are the name of the game – the faster, the better!

- Accounts Payable: Balancing the art of payment timing keeps cash flowing smoothly

(Mismanaging inventory can be a death sentence for your business – READ WHY HERE)

Supercharge Your Cash Flow

Shortening the cash conversion period is the key to liquidity.

Here’s the lowdown on leveling up your cash flow:

- Streamline inventory management to avoid cash traps

- Offer sweet incentives for swift payments

- Master the art of supplier diplomacy to negotiate payment terms

- Embrace new tech for lightning-fast invoicing and payment

- Keep tabs on your cash conversion cycle – optimization is the name of the game

Steer Clear of Common Pitfalls!!!

- Keep an eye on cash flow to avoid a shortage

- Set realistic timelines for receivables

- Cultivate positive supplier relationships for flexible payment perks

Tech for Financial Glory

From accounting apps to forecasting tools, digital finance apps streamline and optimize your business.

For small business owners and online entrepreneurs, the integration of financial technology is a game-changer, simplifying financial management a thousandfold and unlocking new avenues (and time!) for growth.

Finance tech can do SO MUCH for you:

- Automated invoicing and payment

- Forecasting tools for clear financial foresight

- Mobile payment solutions for enhanced customer experience

- Access to capital

- Real-time financial dashboards

With these tech-savvy tools, you’ll have innovative solutions that blow traditional banking and financial services right out of the water.

(For specific app examples and recommendations, check out this guide to navigating financial technology.)

In Closing: Embrace the Cash Cycle, Embrace Success

In your journey of entrepreneurship, mastering the cash cycle is crucial for success.

But mastery is not a destination; it’s a continuous journey of discovery and adaptation.

And in a landscape defined by uncertainty and volatility, the ability to anticipate, mitigate, and leverage cash flow dynamics is paramount.

It’s about staying vigilant, agile, and resilient in the face of ever-evolving challenges and opportunities.

It’s not just about dollars and cents – it’s about understanding the ebb and flow of your business.

Because the cash cycle isn’t just a concept – it’s your business’s lifeline.