If you’re like most business owners, you have a gut feeling about growing your business.

You can anticipate some of the problems around the risks with the economy, your market, your competition, and internally.

But without a good understanding of your numbers, there are some key issues you might overlook.

A good example of this is when you are getting ready to grow your business.

It doesn’t just require that you have cash to buy the things you need like increased inventory or labor; you also need cash available to cover the period between when you bill your new customers and when you collect cash from them.

Business owners don’t usually anticipate this key metric, and this oversight has put some otherwise very solid companies into bankruptcy!

FREE DOWNLOAD: GET THE CASH FLOW FORECASTING TEMPLATE NOW

One Of The Biggest Temptations for Entrepreneurs

Growth is great for businesses, but intentional and well-planned growth should be the goal.

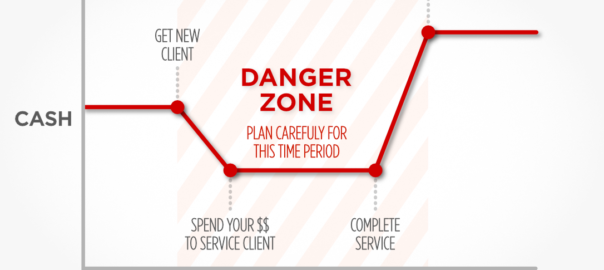

Growing without thoughtful planning – informed by solid financial forecasts – puts small companies into a cash flow danger zone.

It’s not that you shouldn’t be growing. YOU SHOULD.

But you should also be aware of the fact that unhealthy, uncontrolled growth can be a company killer.

According to Inc.com, only four out of 100 businesses survive past the ten-year mark.

One issue behind this statistic is that owners are often prepared for growth conceptually, but don’t understand the cash-flow underpinnings of their plans.

Because remember, cash is king.

When you’re growing a business, you need cash for a number of things.

You will owe your vendors money early, and won’t collect payment from your NEW customers for some period of time. Whether your terms with those customers are for payment within ten, twenty, or thirty days of your invoice, you will need cash on hand to bridge the gap.

If you know how many new customers you can expect and when they will come on board and pay, you won’t stretch beyond your ability to fund that gap.

An accountant or financial leader can build out a model for you that tells puts you in complete control of your growth plan, so that you can execute with the utmost confidence.

Grow the Right Way

How long does it take your customers to pay you?

Or, in accounting speak, what are your payment terms with your customers?

If they pay you in advance, this isn’t an issue at all.

However, if your customers pay you ten, twenty, thirty, or sometimes even sixty days after they get their invoice, your challenge grows exponentially.

And, if you provide payment plans to your customers, it is equally as challenging.

In addition, in real business, there is an accompanying reality check: what you need to reflect in your plans is not the terms you put on the invoice, but the reality of how quickly (or slowly) your customers pay you.

Go back and look at your history of actual cash receipts and use that information to inform your planning!

For example, let’s say you invest your time and money on August 28 to provide a new customer with a product or service; then you bill your customer on August 31.

Technically, even with “due upon receipt” terms, the invoice is due that day, but the reality is that your customer takes a week to open their mail.

And if they take another week to mail the check, you have to deposit it, and it needs to clear the bank (assuming you aren’t taking immediate electronic payments of some sort, you actually have a 14-21 day cycle).

So your “due upon receipt” assumption is really a 14 day cash flow lag.

That miscalculation alone has been known to sink a solid business.

Good financial professionals with enough expertise and knowledge of your business can provide financially informed support for your strategic growth plans.

They might evaluate your history and provide insight into the speed or trajectory at which you should grow.

They can help you develop a fully reconciled model from which you can make incredibly informed decisions based on your assumptions.

A good finance professional is like a GPS for you: You provide the destination, and they show you how fast you can get there.

They will also provide alternatives if it’s not growing fast enough for you.

The excellent finance professional leads with “yes” instead of “no” and will work with you to define the best ways to achieve your objectives, in light of your unique financial realities.

Their job is to help you see the path to making your vision possible.

Your Growth Can Be Healthy and Exponential

Growth is a “ready, aim, fire” proposition; if you reverse that order, and take on too many new clients at once, you can drive cash flow in the wrong direction.

However, if you fully inform your growth plan with realistic cash flow forecasts, business growth can actually fund itself!

Growth can be approached with complete confidence with the right financial input.

And that advice, my friends, is worth its weight in gold.

Author, Virtual CFO, and Finance Coach

“Your First CFO: The Accounting Cure for Small Business Owners” on AMAZON