Still planning on selling your business?

Today I’m going to talk about another HUGE step in preparing for an exit to maximize the value of your business.

And it may be obvious, given my job description, why I push so hard on this one:

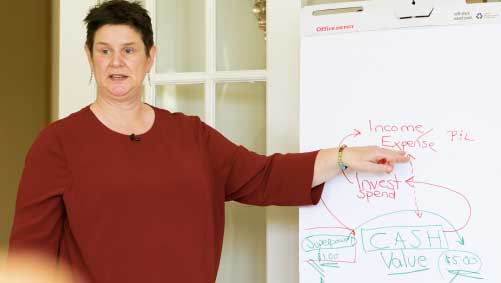

TIP #2: Get Your Financials in Order

Seek Professional Assistance

If I’ve taught you anything, it’s that maintaining precise financial records should be a cornerstone of your business from day one.

If you have had sloppy or inconsistent financials give you headaches in this business, you can bet they’ll raise any and all red flags for potential buyers.

When planning your business exit, one of your first steps should be to engage the support of a Chief Financial Officer (CFO) or a financial expert.

In essence, your CFO or financial expert becomes an integral part of your exit team.

They work in synergy with your legal advisors, business brokers, and other professionals to ensure a well-rounded and comprehensive approach to your exit strategy.

Their expertise complements the skills of others, creating a strong foundation for success.

They can translate the numbers into a compelling narrative that aligns with the story of your business, not only enhancing your credibility but also making your business more attractive to buyers.

They can identify and rectify errors, reconcile accounts, and generate comprehensive financial reports that are essential for due diligence during a sale.

Prepare Detailed and ORGANIZED Historical Records

Potential buyers will obviously want to assess your business’s financial performance over time.

These statements should provide a clear and concise overview of your business’s financial health.

To give them the best possible view, prepare at least three years’ worth of well-documented (that means ACCESSIBLE and WELL-ORGANIZED) financial records.

Your financials should be audit-ready (aka bulletproof), and you should be prepared to address any questions or concerns from potential buyers or their financial advisors.

Disorganized or incomplete financial reports can lead to distrust and a lower valuation during negotiations….

… but quick access to financial reports can expedite negotiations and demonstrate your commitment to a smooth transition!

Your CFO can anticipate these issues and work with you to address them effectively.

The key here – transparency.

An honest representation of your financials builds trust with potential buyers.

Trust me, inflated revenue figures or hidden expenses can come back to haunt you during due diligence.

Work with your bookkeeper here to tie your business financials in a perfect (and accurate) bow and give yourself the best outcome possible.

Mitigate Tax Risks

Keep an eye on your tax obligations.

Unresolved tax issues can absolutely be a deal-breaker for potential buyers.

While working with your financial expert to polish everything up, ensure that your financial records are in compliance with tax laws and that you have a strategy for dealing with any outstanding tax matters.

The sale of a business is not the time for surprises!

Preparing to exit your business is like embarking on a challenging expedition.

To navigate the complex terrain and reach your destination successfully, you need an experienced guide.

The cleaner and more attractive your financial records, the more appealing your business becomes to potential buyers.

When it comes to financials, clarity is king.

Seeking professional assistance, particularly in the form of a seasoned CFO or financial expert, is like having a trusted guide who knows the terrain inside out.

They can help you navigate the complexities, maintain financial integrity, address buyer concerns, and ultimately maximize the value of your business in preparation for a successful exit.

It’s never too late to organize your finances – especially if you’re planning to sell!