Is Your Pricing Leaving Cash on the Table?

Pricing decisions are hard.

Period.

Obviously, we want our businesses to be as profitable as possible – that sounds easy on paper.

But there are so many variables to manage: you need to price your services to stay competitive within your market, to reflect your image, to make sense for your customers; and all the while ensuring you get some profit.

It’s a lot to think about.

But it’s not completely random. In order to get the most out of your pricing, you need a pricing methodology that accounts for these (often conflicting) needs.

When you don’t have a solid pricing model, you’re going to be pricing your services based on a fragmented view of either a) the market, b) what your competitors are charging, or c) what you want to make.

When you build your pricing based on those external factors, one of two things happens:

- You either underprice in order to stay competitive, and leave money on the table.

- Or you overprice in order to make more profit, and end up losing sales.

Neither of which is ideal.

But what about creating a pricing methodology that’s based on the right internal and external variables for your business?

That’s when you hit what I call the “Goldilocks of Pricing” — what you charge won’t be too much, it won’t be too little…

It will be just right.

Developing a Pricing Method

So how exactly do you come up with a pricing method?

Start by asking yourself each of these questions:

- What are your fixed costs and what are your variable costs? Look at what it costs to create your products and services. Fixed costs are the costs in your business that exist independently of any of your products. Fixed costs include things like rent for your office or your computer bill. Variable costs are costs that vary depending on your product. Things like labor or marketing costs specific to a product fall in this category.

- What’s the market like? What are similar products or services demanding in your market? What price point feels reasonable to your ideal customer?

- How will this product contribute to your overall portfolio? Is this product going to be a huge money-maker? Or is it more focused on increasing awareness within your market, or potentially building stronger relationships with your existing customer base?

- How well are you established in your market? Are you new in your space, or do you have an established reputation and customer base? Are you a market disruptor who has to explain that the game is changing, or are you a market follower?

- Are you positioning this product as quality or commodity? Are you marketing this as a high-end investment or as the best deal on the market (Whole Foods vs. Target for groceries)?

- What’s your ultimate goal with your customer? Are you looking to sell and get out, or are you looking to build a long-term customer relationship that includes higher-ticket items down the line? Are you selling a commodity or a partnership?

Capturing all of this information in a spreadsheet and building something that lets you change each variable to test the outcome is the key to determining your pricing structure.

So, for example, let’s say you were new in an established market with a high-quality product, looking to build a long-term, lucrative relationship with your client base.

You’d likely want to price closer to the low end of the highest quality products so that it will stand out as something other than a commodity product. You’ll make sure that price covers your fixed costs, knowing you’re using the product or service as an entry-point to build a relationship with your client base.

But you may be willing to accept a lower profit margin initially.

In this case, it’s more important to think about total profitability with your client base over the next five years than individual profitability on this particular product at this time.

And once you’ve established your reputation within the space, then you can introduce additional services and price them accordingly as the relationship grows.

But no matter WHAT: it is an inescapable ground rule to ALWAYS ensure that the value you are providing to your customers is higher than the price you are charging them.

The Bottom Line

The bottom line is, when you’re creating your pricing method, you want to set up a model that incorporates all of those factors and gives you a price that makes sense for each product or service launch.

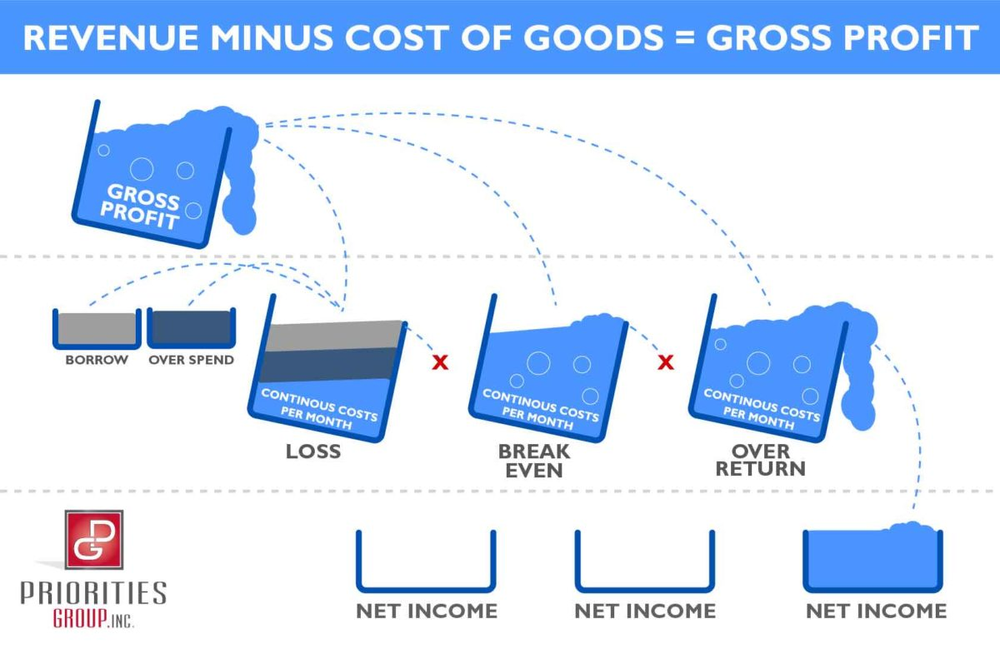

You also need to have a clear understanding of the profitability of your pricing structure.

In order to really be successful, you need to be able to look at your numbers and explain your profitability with 100% certainty.

Otherwise, you don’t have enough information to know whether you’re making or losing money with a product, which can be really risky for your business.

Ideally, you’ll create a portfolio that features a wide variety of products and services that fulfill different needs in your business.

You might have one product family for which the entire purpose is to get your name in front of the right audience, and you might run that product line at a loss or break-even.

But then you have another product line that’s at a high price point for your highest-quality customers and pours out cash to you.

And that’s okay!

It doesn’t matter if most of your profit is coming from product line A and product line B is barely breaking even — all that matters is that when you add the margins from those product lines, they cover your fixed costs and desired profit.

When you have this kind of pricing method in place across your portfolio, it allows you to make sound, strategic decisions about when to focus on which products for maximum profitability.

With this kind of information, if you have a low-cash period in your forecast, you could strategically shift your marketing focus to your cash-cow product to bring more money in the door.

Or, if your bank balance is pretty high for a period of time, then it may be time to look at investing in a new product launch.

Pricing is a complex beast, but once you get your methodology in place across your entire portfolio, it will become an invaluable strategic tool, enabling you to see the big picture and make the best long-term decisions for the long-term profitability of your company.

Pam Prior

Author, Virtual CFO, and Finance Coach

“Your First CFO: The Accounting Cure for Small Business Owners” on AMAZON

“Founder to Exit: A CFO’s Blueprint for Small Business Owners” on AMAZON

***Disclaimer: This post is for informational purposes only and does not constitute financial or legal advice. Consult with a professional before making any financial decisions.