Do I need an Accountant, Bookkeeper, or CFO? This is one of the most common questions we receive.

In this post, we’ll define these key roles for you and help you decide which is the right choice for your business.

What’s The Difference Between These Roles, And What Should You Expect From Them?

1. Bookkeeper

Bookkeepers may or may not have a two- or four-year accounting degree.

They should always understand the basics of the accounting equation, and what at least two of the three main financial reports reflect.

Their job is to pay every bill, invoice every client, collect every dollar, book every business transaction in your financial records, and create your Profit and Loss Statement and Balance Sheet.

Your bookkeeper can be anyone, from Aunt Millie who’s been “doing the books in your company for 20 years,” to incredibly professional, outsourced, certified bookkeepers

FREE DOWNLOAD: GET THE CASH FLOW FORECASTING TEMPLATE NOW

2. Accountant

Accountants come in a number of forms. First of all, some have a CPA (Certified Public Accountant license), and some don’t.

Both are accountants!

Accountants with a CPA usually also have an undergraduate four-year degree in accounting.

In many cases they’ve worked in the public accounting field for some time as either an auditor or a tax accountant. (In fact, in most states, in order to get their license, they are required to have some time at a public firm, or doing the work of a public firm.) They’ve also taken and passed a national certification exam, and have maintained ongoing educational credit requirements.

There are some, however, who started as bookkeepers in an organization and rose in the ranks to a role that’s called accountant.

In addition, some graduating accounting undergraduates go straight into industry without touring through public accounting and obtaining a CPA first.

Now that doesn’t cover all possible permutations, but it is a good generalization.

One difference between internal accountants, homegrown accountants, and CPA’s is that the CPA–by virtue of their licensing–has liability associated with their job performance.

They are held to a set standard of performance, education, and understanding, and as such, are required to perform to the standards of the profession.

An internal accountant (whether a CPA or not), usually performs what’s called management accounting. They usually book some entries to the books of record and generate the monthly financial reports. From there, the responsibility levels vary from distributing reports to performing complex financial analysis.

A bookkeeper tends to be less integrated with the overall business. They tend to record transactions based on a fixed process and then passes a download of those transactions to a tax accountant at year-end. The tax accountant then files the tax returns.

And the critical piece that’s missing there is management accounting.

Sometimes smaller companies don’t have someone in the organization extracting the key information from the monthly closing process that will help the business leader to understand and adjust the key business levers in the organization.

Because if there’s no internal accounting function, this is often overlooked.

Management accounting is the function that translates bookkeeping into Entrepreneur- or Business Owner-speak. In larger organizations, this is what finance groups and internal accountants usually do; they capture the bookkeeping information and turn it into meaningful management reporting.

BUT – even small businesses deserve to have this level of business understanding as well! And it’s not always as costly as you may think to have someone set up a process to extract this value for you.

3. CFO/Controller

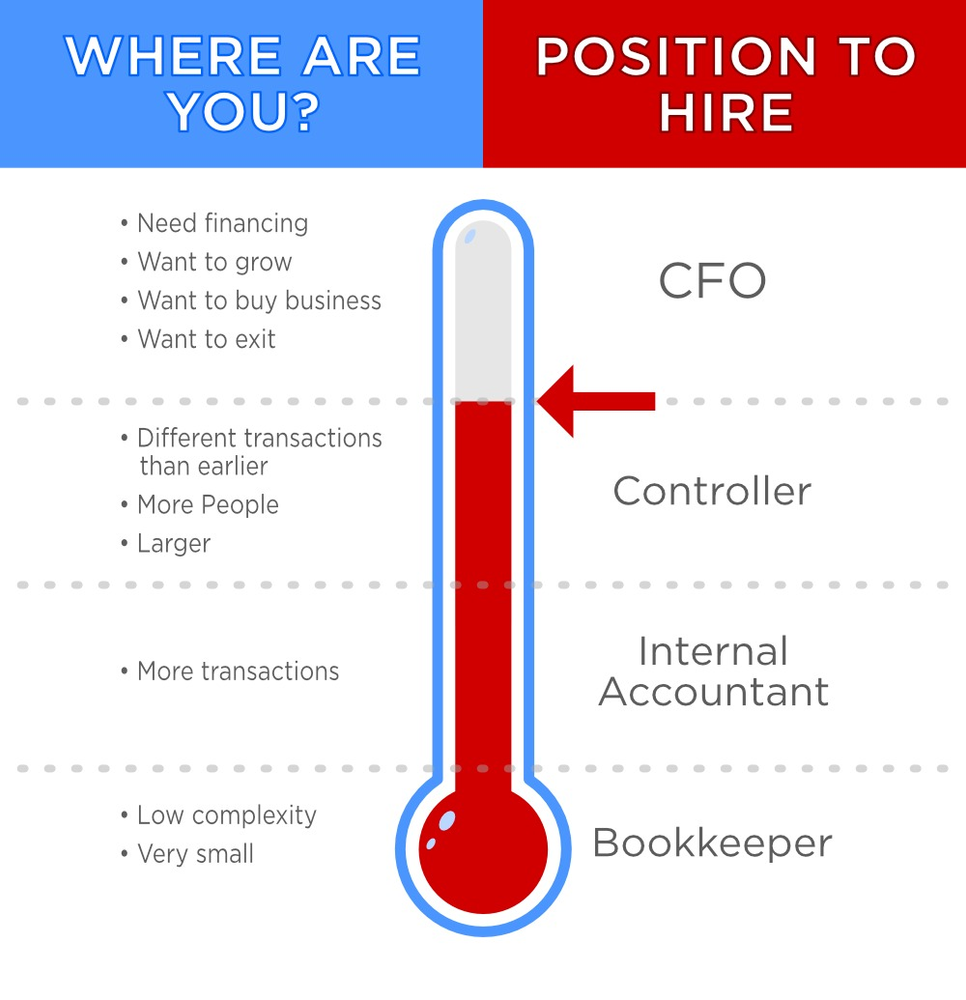

If your business has risen to a level of complexity at which your transactions, business model, or financing needs have overwhelmed your current reporting, it may be time to introduce the role of Controller or CFO (An example of this is a point at which you need to get funding for growth).

The Controller makes sure that your reporting and bookkeeping is correct, well-controlled, reliable, and consistent.

The CFO would use that information to help decide the best source of funding, prepare the pitch deck story for that funding, and attend the presentations.

They are the interface between the books and the strategy.

CFO’s combine the story and numbers of the business into a compelling deliverable; they use the story to attract a client, explain something to a banker, talk to an auditor, or lay out a growth plan.

You need a CFO if you need someone to extract and communicate meaning from your numbers.

Which Finance Role Do You Need?

If you’re looking to grow or restructure your business, consider someone with experience as CFO.

Finance roles work like the process of writing a book:

- The bookkeeper is the person who puts the words on the page

- The accountant organizes the words and groups them into chapters

- The CFO crafts the story and ensures alignment with company strategy

The right finance role for your business depends on the size of your company, its complexity, and your goals for the future. If you think it’s time to hear more, we are here to help.

FREE DOWNLOAD: GET THE CASH FLOW FORECASTING TEMPLATE NOW

Author, Virtual CFO, and Finance Coach

“Your First CFO: The Accounting Cure for Small Business Owners” on AMAZON